Bates Research | 11-09-23

A Look At 2023 FINRA Arbitration Award Stats: What’s Trending, What’s Not?

With the year wrapping up soon, we are taking a look at what is and is not trending in matters resolved through FINRA arbitration through the first nine months of 2023. The following analysis utilizes data from Securities Arbitration Commentator and FINRA.[1]

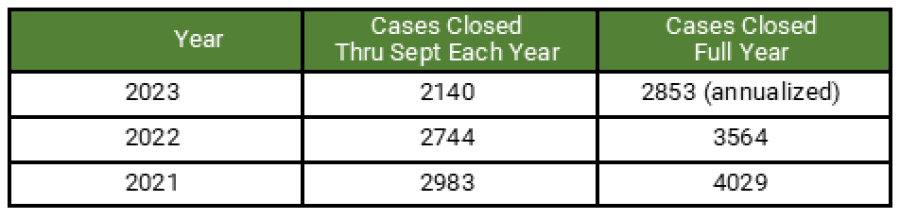

The Big Picture – Fewer Cases Closing Each Year

Through September of each year, and on an annual basis, the number of disputes closed has been declining. This is a long-term trend going back at least a decade following a similar decline in disputes filed – no real surprise to those who work in the FINRA arbitration space and have experienced the impact of recent bull markets[2], the transition of advisors away from broker-dealer firms to registered investment advisory firms[3], and advancements in firms’ compliance and supervisory systems.

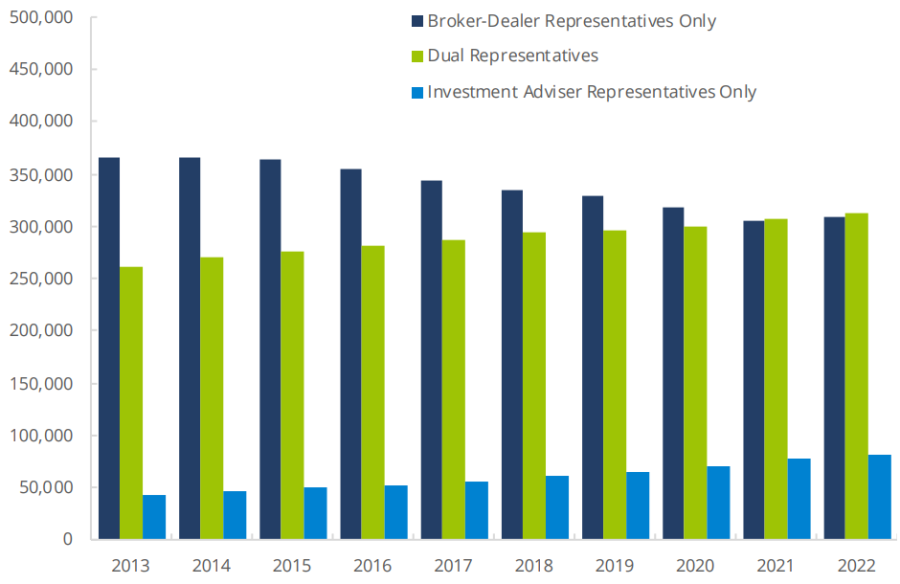

The chart below [4] demonstrates the decline in the number of Broker-Dealer Representatives Only and the increasing numbers of Dually Registered Representatives and Investment Adviser Representatives Only.

It is worth noting that FINRA reports 2022 as being the first year since 2015 that more FINRA-registered representatives entered the industry than left the industry. [5]

Types of Disputes

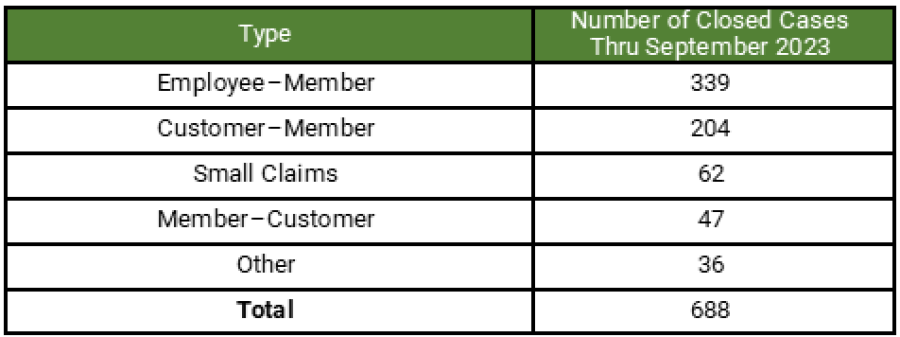

Nearly half (49.2%) of the disputes resolved through the FINRA arbitration process in the first nine months of 2023 were Employee–Member cases, and 29.6% were Customer–Member cases.

In the first nine months of 2023, the major case types that were closed were:

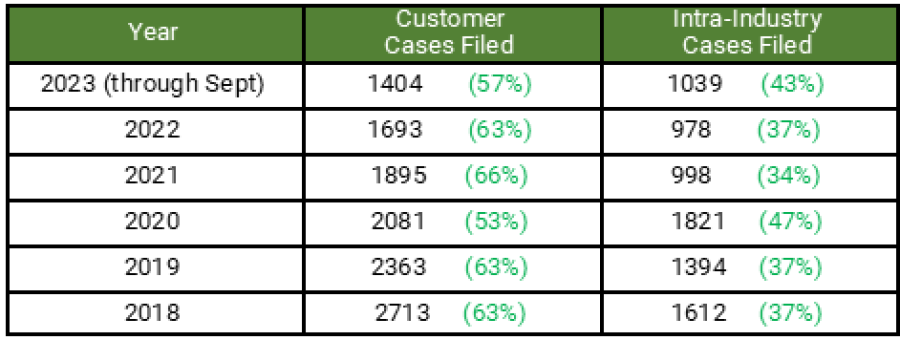

FINRA classifies types of disputes as either Customer Cases or Intra-Industry Cases, and this data is tracked by the number of cases filed, not closed.

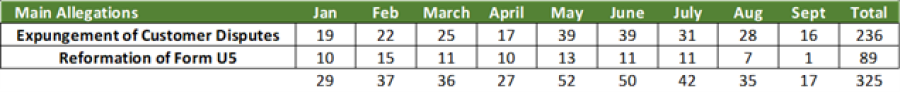

Employee–Member Disputes

The majority of allegations for Employee–Member disputes that were arbitrated through September 2023 involve Expungement of Customer Disputes and Reformation of U5 Disclosures. Together, these two allegations represent 95.9% of the total Employee–Member dispute allegations.

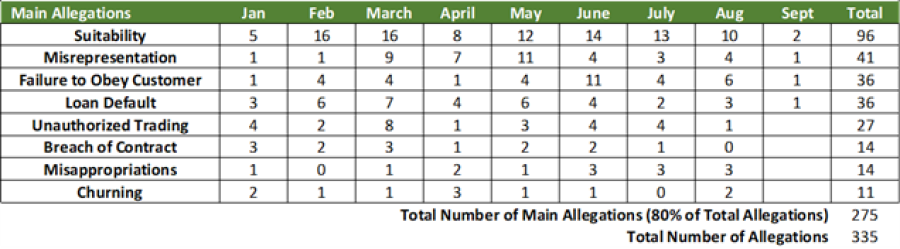

Customer–Member Disputes

The main eight allegations associated with Customer–Member disputes that were arbitrated through September 2023 are listed in the table below. These allegations represent 82% of the total allegations seen in Customer-Member disputes arbitrated through September 2023.

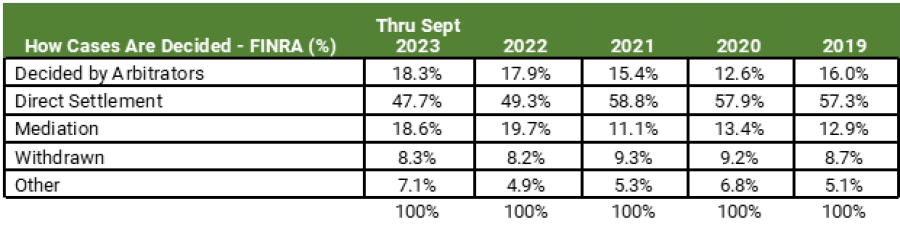

The Hidden Statistic:

A smaller percentage of Customer–Member disputes are being resolved through direct settlement.

In 2022 and YTD 2023, FINRA reports the percentage of cases decided by Arbitrators has increased when compared to the prior three years. The same trend is exhibited for cases being decided through mediation, with the percentage of cases decided through direct settlement declining by close to 10%.

The FINRA arbitration forum is constantly evolving and changing. To discuss any of the above, or how Bates can assist with your customer–member and employee–member cases, please contact:

[1] https://www.finra.org/arbitration-mediation/dispute-resolution-statistics.

[2] Recent Bull markets include March 2009 to December 2019 and Late March 2020 to January 2022. https://www.forbes.com/advisor/investing/bull-market-history.

[3] Registered Investment Advisors must register with the U.S. Securities and Exchange Commission (SEC) or a state regulatory agency, depending on the value of assets under the RIA's management. Disputes involving Registered Investment Providers are not governed by FINRA and therefore are not reflected in the analysis contained herein.

[4] Figure 1.1.8 2023-industry-snapshot.pdf (finra.org)

[5] See Figure 1.2.1 2023-industry-snapshot.pdf (finra.org)