Bates Research | 01-23-24

Key Takeaways from the SEC’s 2024 Examination and Enforcement Priorities with Bates Group’s Comparison Chart

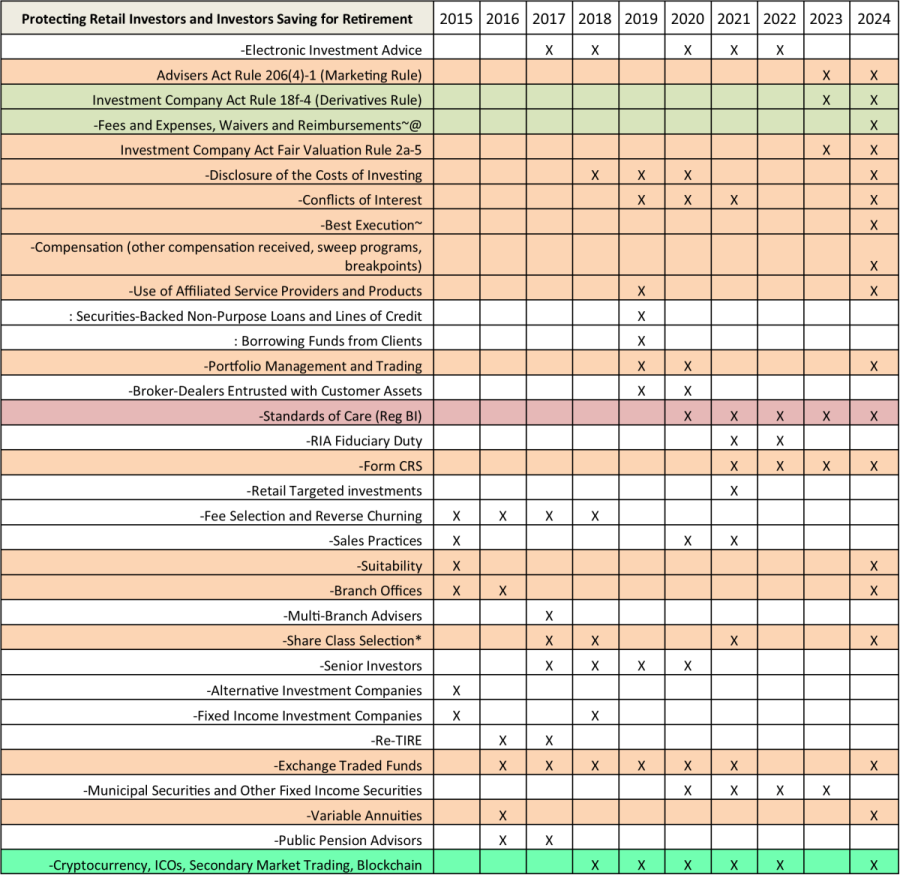

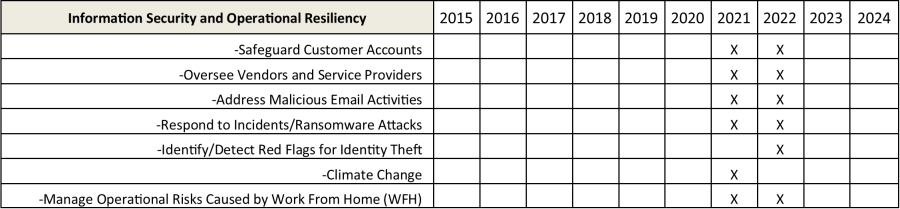

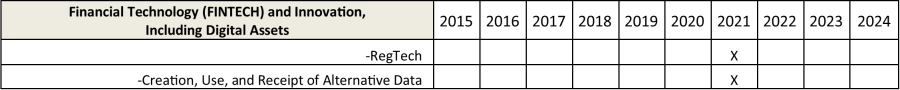

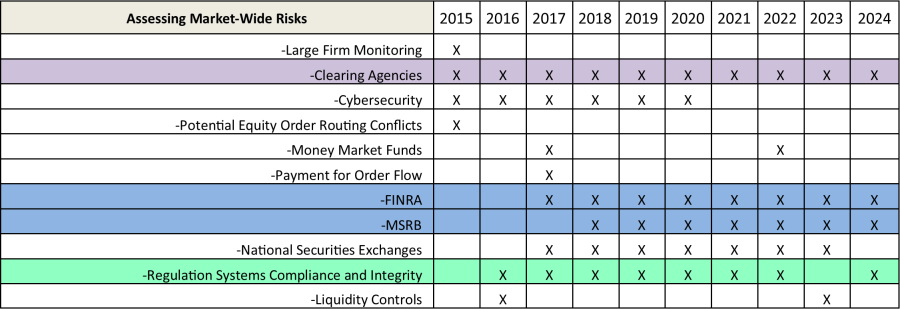

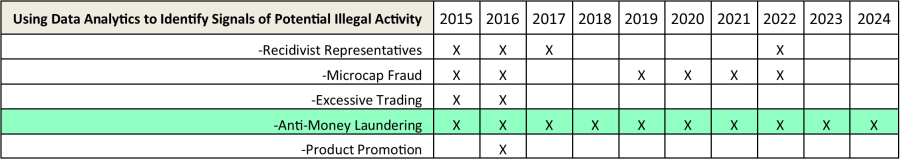

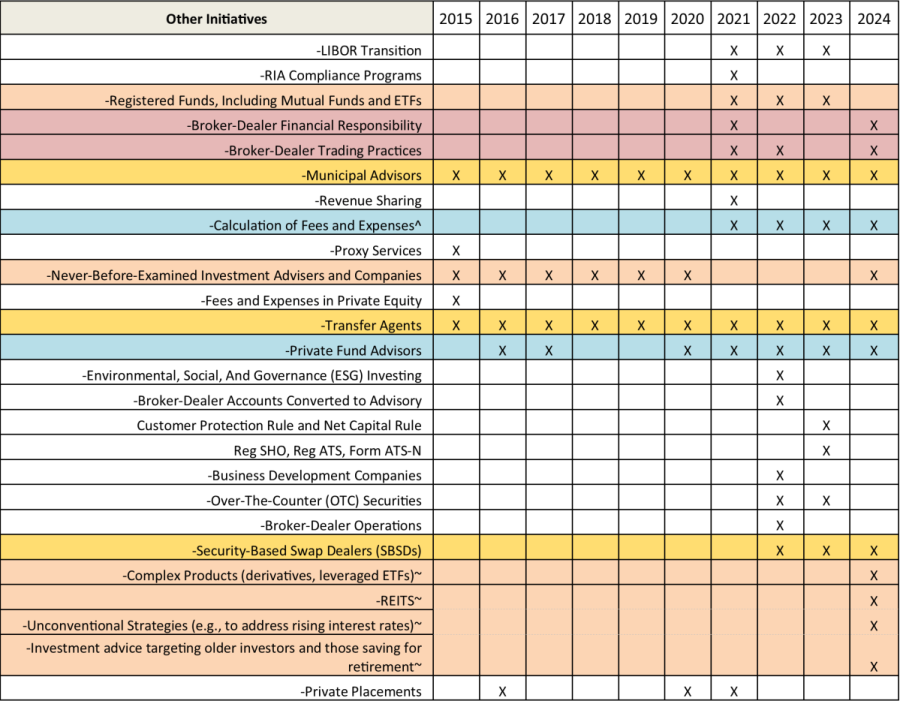

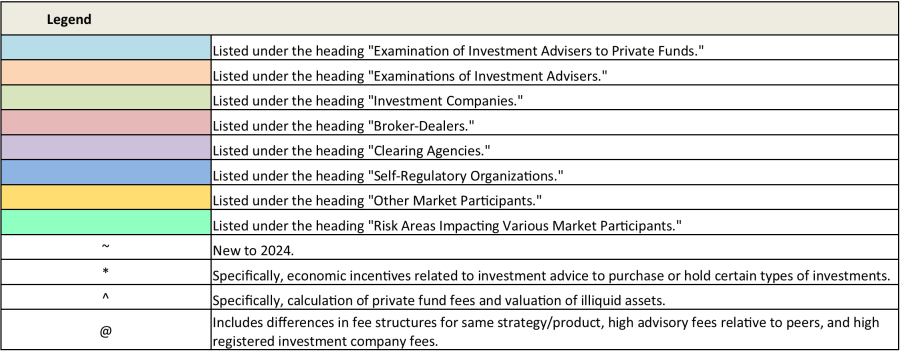

In its 2024 examination priorities report, the SEC’s Division of Examinations highlights areas where it will intensify scrutiny and regulatory focus in the coming year. Reviewing their roadmap offers vital insights for firms (investment advisers, investment companies, broker-dealers, self-regulatory organizations, clearing agencies, and other market participants) on where to focus their attention and resources regarding potential risks to ensure proactive compliance in the coming year. Bates has been tracking the evolution of the Division's published priorities for nearly a decade -- see our 2024 comparison chart below.

Focus areas include:

1. Investment Advisers and Investment Companies:

- Private Funds: The Division will examine complex and “fee-heavy” private funds, particularly those who are perceived to have opaque strategies, conflicts of interest, and misleading marketing practices. Retail investor protection in this space is paramount.

- Fees and Valuation: Fee structures, portfolio valuation methods, and transparency will be under the microscope, particularly for advisers catering to retail clients.

- Suitability and Performance Advertising: Adequacy of advice relative to investor profiles and responsible use of performance advertising in marketing materials will be closely examined.

2. Broker-Dealers:

- Best Execution and Suitability: Evaluating client interests in relation to commissions charged is the top priority. The suitability of recommendations for individual investors will be rigorously assessed.

- Margin Lending and Manipulation: Responsible use of leverage and transparency in risk disclosure for margin lending activities will be key focus areas. Potential market manipulation will be actively investigated.

- Cybersecurity and Sales of Complex Products: Robust data protection measures, incident response plans, and responsible sales practices for complex products are crucial aspects that will be evaluated.

3. Self-Regulatory Organizations (SROs):

- Oversight Effectiveness: SROs' ability to enforce SEC regulations and compliance within their member firms will be scrutinized.

- Market Surveillance and Enforcement: The adequacy of SROs' surveillance programs to detect and address market manipulation and misconduct will be assessed.

- AML/CFT Compliance: SROs must ensure strong AML/CFT programs, particularly for member firms vulnerable to money laundering risks.

Emerging Risks:

- Information Security: Robust cybersecurity measures, data protection systems, and incident response plans are critical to mitigate cyber threats and ensure business continuity.

- Crypto Assets: Firms dealing in or offering services related to crypto assets must comply with evolving regulations and adhere to responsible market practices.

- Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT): Effective AML/CFT programs are essential for all firms, especially those susceptible to money laundering risks.

Actionable Takeaways:

The SEC's 2024 exam priorities offer a roadmap for firms to proactively address potential risks and enhance compliance. Essential action items for firms for the coming year include:

- Focus on transparency and investor protection: Prioritize clear fee structures, accurate portfolio valuation, and suitability of advice, particularly for retail investors.

- Implement robust cybersecurity measures: Protect sensitive data, have effective incident response plans in place, and adopt best practices for secure technology use.

- Ensure responsible sales practices: Avoid misleading marketing tactics, evaluate clients' needs in light of commissions charged, and offer suitable products based on individual risk profiles.

- Strengthen AML/CFT programs: Regularly update and test AML/CFT procedures, identify and mitigate money laundering risks, and cooperate with regulatory authorities.

- Stay informed about evolving regulations: Keep abreast of changes in regulations, particularly regarding complex products like private funds and crypto assets — as well as what the Division may view as "new or emerging risks, products and services, market events, and investor concerns."

By proactively addressing these focus areas and emerging risks in 2024, firms will help build trust with investors, enhance compliance, and confidently navigate the regulatory landscape in the year ahead.

Bates 2024 SEC Priorities Chart