Bates Research | 03-08-23

The New Jersey Digital Asset and Blockchain Technology Act: A Better Licensing Alternative than New York?

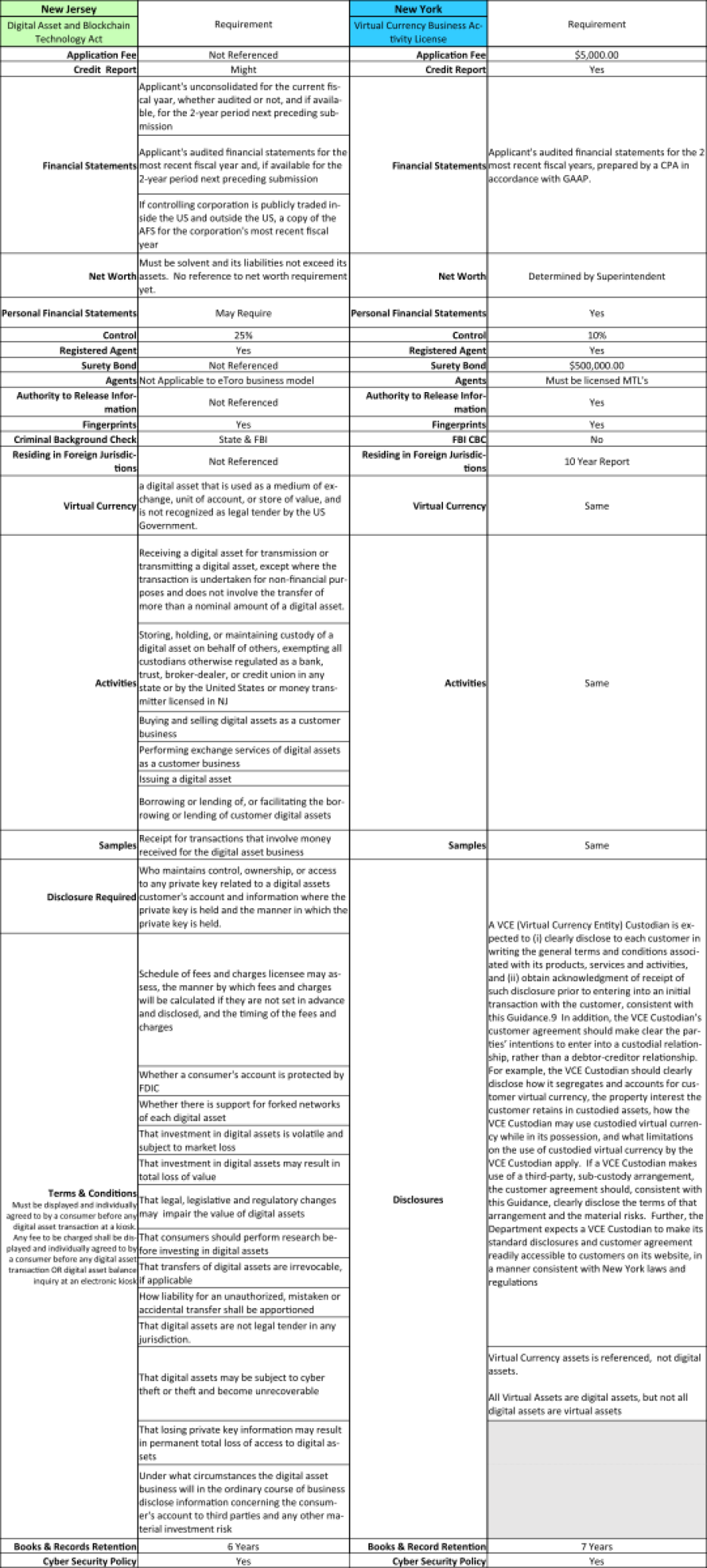

In the coming months, the New Jersey legislature is expected to pass the Digital Asset and Blockchain Technology Act A2371/S1756 (“the Act”), a bill that would establish one of the broadest licensing and regulatory frameworks on digital assets in the country. On January 19th 2023, the bill was adopted by the New Jersey Senate Appropriations Committee by a wide margin, virtually guaranteeing its passage. The legislation is being closely watched as it offers companies a more comprehensive alternative to the current standard for the regulation of digital assets prescribed under New York law (see Comparison Chart below). Here’s a short summary.

The New Jersey Framework

The Act aims to create an enabling environment for businesses to transact in digital assets and use blockchain technology under rules that protect consumers. The proposed regulatory framework would allow entities to register as "Digital Asset Service Providers" (DASPs)

in order to engage in transactions involving digital assets, secure their data on blockchain networks, and make use of smart contracts. The new framework would reduce legal uncertainty and enable businesses to reap the benefits of using digital assets and blockchain technology. Consumers would be assured that their transactions will be legally valid, thereby making digital asset usage even more attractive. The new framework is intended to foster an environment that would promote innovation while ensuring proper legal safeguards. If enacted, it will be a significant change to the regulatory framework for organizations providing cryptocurrency services to residents of New Jersey.

Requirements for Certain Activities

Under the Act, businesses would require licensure by the bureau if they engage in the following activities:

-

Receiving a digital asset for transmission or transmitting a digital asset, except where the transaction is undertaken for nonfinancial purposes and does not involve the transfer of more than a nominal amount of a digital asset

-

Storing, holding, or maintaining custody of a digital asset on behalf of others, exempting all custodians otherwise regulated as a bank, trust, broker-dealer, or credit union in any state or by the United States or as a money transmitter licensed in New Jersey

-

Buying and selling digital assets as a customer business

-

Performing exchange services of digital assets as a customer business

-

Issuing a digital asset

-

Borrowing or lending or facilitating the borrowing or lending of customer asset

The Act shifts regulatory oversight to the New Jersey Bureau of Securities (“the Bureau”), which has been active in enforcing cryptocurrency and blockchain-related matters. Key regulatory provisions of the Act include:

-

Regulation by the New Jersey Department of Banking and Insurance, which is responsible for supervision and enforcement of the Act

-

Clarification that digital assets are not to be considered securities or money transmission instruments

-

Licensing requirements for businesses engaging in virtual currency business activity, including registration fees and other conditions

-

Standards of conduct for virtual currency businesses, such as providing consumer disclosures, maintaining records and safeguarding assets

-

A framework for the use of smart contracts

-

Immunity from civil and criminal liability for depositors who are not engaged in virtual currency business activity

-

Establishing a digital asset owner’s right to control their own digital assets, including freedom from seizure or confiscation.

Licensing, Fees, Minimum Capital, Reporting Considerations

The Act requires all businesses to obtain a license from the State of New Jersey Department of Banking and Insurance before engaging in any activities that involve digital assets or blockchain technology. This includes companies providing retail and custodial services, digital asset trading platforms, digital asset clearing and settlement services, and digital asset storage companies.

The Act also sets out a number of requirements for licensees, including minimum capital levels that must be held by the company as well as compliance procedures for anti-money laundering and consumer protection programs. In addition to licensing requirements, the Act outlines the obligations of licensees to supervise their operations, report suspicious activity, and maintain records of all transactions.

Finally, the Act imposes a series of sanctions on businesses who fail to comply with the licensing requirements or associated regulations which includes a penalty of $500 per day, from the first day the department issues a notice of failure to apply a license until a license application is filed with the department.

Once enacted, the Bureau will issue a form document that all digital asset businesses that conduct business with the people of New Jersey will need to complete and submit along with a $1,000 nonrefundable fee. In addition, the Bureau will require new disclosure and compliance regimes as far as it decides are appropriate, and within the confines of the law. The proposed penalties for failing to abide by the provisions of the license could be as much as $10,000 for a first offense and $20,000 for a second offense, as well as $500 a day for conducting a digital asset business without a license. The Act follows the trend for more aggressive and robust enforcement abilities and compliance regimes for digital assets as governments look to protect consumers and punish bad actors in the space.

The bureau has said that they will grant or deny any license application within 120 days of receipt of a completed application.

How Does New Jersey’s Proposed Act Compare to New York's?

Chart compiled by Matt Summers, Director, MSB and State Licensing, Bates Group

Conclusion

The New Jersey Digital Asset and Blockchain Technology Act is more comprehensive than the New York BitLicense framework. It follows a trend of aggressive and robust compliance enforcement as regulators demonstrate their efforts to protect consumers and punish bad actors.

It takes into account the custody and control concerns that have led to cryptocurrency frauds and bankruptcies. By creating comprehensive regulations, the New Jersey Act may offer better protection for licensees than the NY framework. Bates will keep your apprised of developments.

How We Can Help Your Firm

Bates can help businesses understand the licensing requirements of the New Jersey Digital Asset and Blockchain Technology Act. Our experienced team of AML, compliance and state licensing professionals, is well-versed in understanding the nuances of this Act and how it applies to distinct types of business operations. We provide a comprehensive assessment, addressing all areas of licensing acquisition and maintenance throughout the United States, including within hard to obtain license states, such as New York.

Contact us today to discuss this article and your licensing needs: