Bates Research | 03-13-23

Banking Alert: Silvergate Capital, Silicon Valley Bank, and Signature Bank

by Greg A. Kyle, Director and Expert

It’s been a chaotic and whirlwind week in the banking sector. On Sunday, March 12, U.S. regulators seized Signature Bank, and on Friday, U.S. regulators seized the assets of Silicon Valley Bank (“SVB”). The seizure of SVB led to one of the largest bank failures in U.S. history and the largest failure of a financial institution since the 2008 financial crisis. SVB, with approximately $209 billion in assets, is the second largest failure, the largest was the collapse of Washington Mutual with approximately $300 billion in assets in 2008. The failure of SVB comes on the heels of Silvergate Capital announcing on Wednesday that it would voluntarily wind down operations and liquidate its bank.

These back-to-back bank collapses in one week spooked the financial markets on Thursday and Friday, leading to a sharp sell-off in a number of banking stocks. Shares of PacWest Bancorp (PACW) fell 37.9% on Friday, Signature Bank (SBNY) shares were down 22.9%, First Republic (FRC) fell 14.8% and Western Alliance Bancorp (WAL) shares were down 13%. Larger banks were also impacted, losing $52 billion in market value during the course of Thursday’s trading.[i]

Adding to market concerns was U.S. Treasury Secretary Janet Yellen’s comments before the House Ways & Means Committee Friday morning in which she stated, “There are recent developments that concern a few banks that I'm monitoring very carefully. And when banks experience financial losses, it is and should be a matter of concern.”[ii]

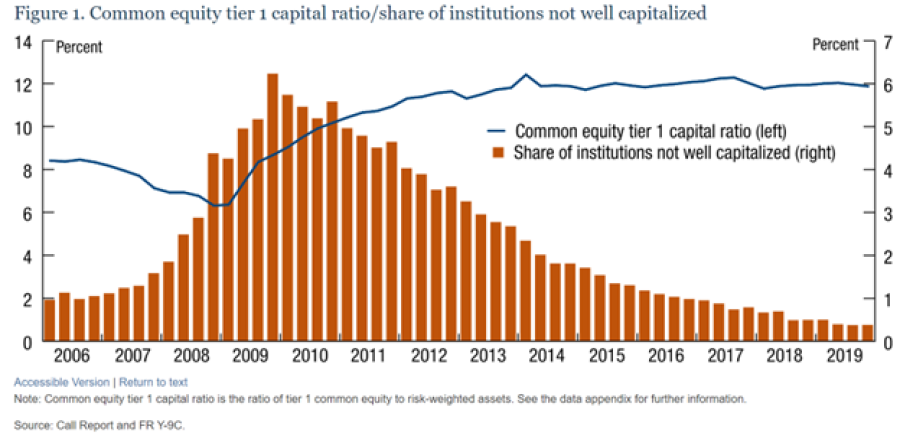

This has raised questions regarding the stability of the banking system and whether we could be facing a replay of 2008’s financial crisis. Although we cannot predict the future, the banking system is stronger today than during the 2008 financial crisis. For one, capital requirements have been strengthened. In 2008 the average Tier 1 common capital ratio dropped close to 5%[iii], while today, in contrast, Tier 1 capital ratios are on average around 12% as depicted in the chart below from the Federal Reserve. Another factor is that the quality of capital is better today than during the financial crisis. And third, liquidity positions are much stronger. In aggregate, the banking industry’s holdings of liquid assets (liquid assets as a share of total assets) are at 24%, nearly four times higher than in 2008.

So what did happen with SVB and Silvergate Capital that led to their collapse last week? We believe that very different driving factors precipitated the collapse of each bank.

While it’s still too early to draw definitive conclusions, it appears that Silicon Valley Bank’s collapse started with a traditional failure of managing interest rate risk due to a mismatch between its assets and liabilities. This led to a historical issue highlighted in the film It’s a Wonderful Life, as opposed to some new technology-related risks. As subsequent information showed, duration (or cash flow) mismatching increased the bank’s exposure to interest rate risk and led to losses when it sold securities. In addition, the bank was also hit with a classic, if unwarranted, historical run on a bank.

A Primer

First, a primer: In effectively managing interest rate risk, financial institutions use a duration matching strategy to match the duration (maturity) of a pool of assets with the duration (maturity) of a pool of liabilities.[iv] In other words, short-term liabilities should ideally be matched or offset by short-term assets. However, if deposits (liabilities) are all short-term in nature and securities (assets) are all long-term in nature, then to pay back liabilities or deposit withdrawals, an institution may need to sell long-term assets if not enough cash on hand is available to meet liabilities. This may be fine in a period of stable interest rates when there is unlikely to be a significant change in the value of long-term bonds for instance, but if interest rates begin to rise those bonds will begin to lose value as a result.

During periods of very low interest rates, firms may be tempted to purchase longer-term assets despite holding short-term liabilities in order to try and increase the spread being earned (the difference between the rate paid by the bank to depositors and the rate earned on the bonds, for instance). The risk in this strategy is that when interest rates rise and those longer-term securities need to be sold, those securities would be sold at lower prices than when purchased, resulting in sometimes large losses. The longer the duration of a bond, the more sensitive the price is to changes in interest rates.

This is because there is an inverse relationship between interest rates and bond prices. When interest rates rise, bond prices fall, which is in fact what occurred with fixed income securities recently. As the Fed rapidly increased interest rates in 2022 and early this year, bond prices experienced one of their worst declines in prices in nearly a hundred years.

Silicon Valley Bank

Now back to Silicon Valley Bank. On Wednesday, March 8th SVB filed a current report with the SEC providing a mid-quarter update. In the update, the company announced that it sold $21 billion in securities resulting in an estimated $1.8 billion realized loss.[v] On Thursday, March 9th Standard and Poor’s downgraded SVB Financial Group to BBB- citing among other things, a higher than expected “pace of deposit outflows”[vi] in the first two months of 2023. The reason for the higher-than-expected deposit outflows was because of the concentrated nature of its deposit base (customers), about 40% of which were from early-stage technology and life science/health care companies. With a slowdown in venture funding in late 2022 and early this year, those early-stage companies were burning through their cash stockpiles (deposits) at an accelerated rate. In order to meet those withdrawals, SVB sold the $21 billion in available-for-sale fixed income securities which resulted in a $1.8 billion loss.[vii]

The $1.8 billion loss appears to be due to an issue known as duration mismatching and forced selling. The bank’s deposits were virtually all short-term in nature (could be withdrawn at any time). However, the available-for-sale securities were primarily intermediate and longer-term in nature. According to SVB Financial Group’s annual filing with the SEC, at the end of 2022 the firm had $13.8 billion in cash and cash equivalents, and $26.1 billion in available-for-sale securities, primarily in U.S. Treasuries and Agency MBS securities. Of the $26.1 billion, only 4% were in securities with a maturity of one year or less. Roughly 56% were in securities with a maturity between one and five years and approximately 40% were in securities of five years or greater. Remember, the longer the duration (maturity) of a bond, the greater the sensitivity of that bond’s price is to changes in interest rates.

Adding to the bank’s woes, it turned out that there was a precipitous run on the bank on Thursday, March 9th. According to a filing by California regulators on Friday, March 10th, despite the bank “being in sound financial condition prior to March 9, 2023, investors and depositors reacted [to the bank’s prior day’s financial update] by initiating withdrawals of $42 billion in deposits from the Bank on March 9, 2023, causing a run on the Bank.”[viii] This forced California regulators to take possession of the bank and name the Federal Deposit Insurance Corp. (“FDIC") as the receiver.

Silvergate Capital

Unlike Silicon Valley Bank, which had “minimal exposure to cryptocurrency and digital assets”[ix] Silvergate Capital and its subsidiary, Silvergate Bank, was an institution that was heavily concentrated in the cryptocurrency and digital asset sector and made the decision to voluntarily wind down its operations. As a result of the dramatic downturn/meltdown in the crypto sector, Silvergate experienced a 68% fall in customer deposits in the last quarter of 2022 and posted a $1 billion net loss.[x] The heavy concentration in the crypto sector, in addition to governance concerns,[xi] severely weakened its financial position and led to low Tier 1 capital levels.

There were additional issues with Silvergate. On March 1st, the company announced in a regulatory filing with the SEC that it was unable to timely file its annual report for 2022 and that the large losses would “negatively impact the regulatory capital ratios” with the result that the bank could be “less than well-capitalized.”[xii] Silvergate also stated in its SEC filing that it was evaluating its ability to continue as a going concern.

Different circumstances, different fundamentals for Silvergate compared to Silicon Valley Bank.

Signature Bank

On Sunday evening, March 12th, just as this banking update was going to press, New York State Department of Financial Services announced that it was taking possession of Signature Bank and appointing the FDIC as receiver "in order to protect depositors."[xiii] The New York based financial institution had deposits totaling $89 billion as December 31, 2022 and total assets of $110 billion. Although the bank had been considered one of the major banks in the cryptocurrency space, it disclosed in its annual 10-K filing with the SEC that it was focused on reducing exposure to the digital asset sector, and as of December 31, 2022, the bank’s digital asset exposure was 20% of total deposits.

Is Contagion a Risk?

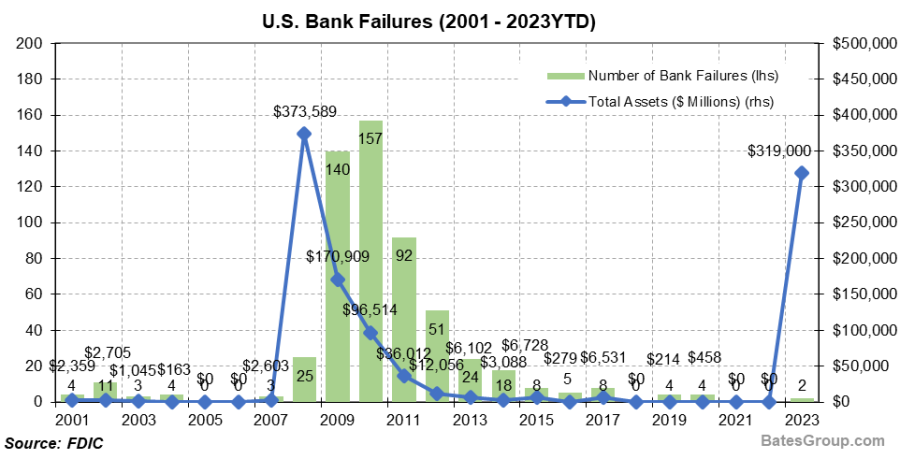

Where does that leave the banking sector as a whole? While high-profile, these three bank collapses do not appear to hint at a larger malaise in the financial sector. It’s worthwhile to remember that bank failures are a relatively common occurrence. Since the financial crisis, the U.S. banking system has experienced over 215 bank failures (although in the last six years, only 18 banks have failed).[xiv]

And—as we pointed out earlier in this update—capital ratios, the quality of assets, and liquidity positions are much stronger today than during the lead-up to the financial crisis. The continued adoption of Basel III capital requirements is also strengthening financial institutions in the U.S.

While there may be risks for individual banks, the risk of contagion and systemic banking failures appears unlikely. Rising interest rates could continue to negatively impact bank profit margins as some banks may not have effectively matched the duration of assets to liabilities leading to interest rate risk. However, unlike 2008, credit risk appears to be minimal as much of the securities being held by banks today consist largely of U.S. Treasuries and other government (Agency) bonds. Also, the majority of banks have a diversified deposit base and solid liquidity position.

To calm fears of a contagion and strengthen public confidence in the U.S. banking system, the U.S. Treasury, the Federal Reserve and FDIC released a joint statement on Sunday evening announcing that depositors in both Silicon Valley Bank and Signature Bank would be fully protected and “will have access to all of their money starting Monday, March 13.”[xv] The terms provided in the joint statement indicated that senior management at both entities had been removed, and that “shareholders and certain unsecured debtholders will not be protected.” The statement also indicated that “no losses will be borne by the taxpayer” and that any such losses will be recovered by a special assessment on banks as in a typical takeover.

The one thing that cannot be foreseeably predicted is the risk of a widespread crisis in confidence in the banking system and a wholesale run on deposits. Then again, panic runs are rarely supported by underlying fundamentals. Bates will continue to keep you apprised.

About the Author:

Greg Kyle is a Bates Group director and expert based in New York. He uses his extensive background in the securities industry to consult and provide expert witness testimony on matters involving fixed income and credit market performance and analysis including mortgage- and asset-backed securities, equity market and security valuations, sector and asset allocation analysis, and fund risk disclosures. Mr. Kyle still actively analyzes the financial markets and publishes analyses of the economy and the capital markets.

[i] The WSJ, Banks Lose Billions in Value After Tech Lender SVB Stumbles, March 9, 2023.

[ii] https://www.reuters.com/markets/us/yellen-expressed-confidence-regulators-after-meeting-svb-2023-03-10/

[iii] See Federal Reserve Bank of Boston, Bank Capital: Lessons from the Financial Crisis, February 5, 2013. (https://www.bostonfed.org/news-and-events/speeches/bank-capital-lessons-from-the-us-financial-crisis.aspx)

[iv] See Federal Deposit of Insurance, RMS Manual of Examination Policies, Sensitivity to Market Risk, p. 7.1-17, July 2018. (https://www.fdic.gov/regulations/safety/manual/section7-1.pdf)

[vi] Standard & Poors’, SVB Financial Group Long-Term Rating Lowered to 'BBB-' From 'BBB' On Weaker Funding Profile; Outlook Negative. March 9, 2023. (https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/2958379)

[viii] https://dfpi.ca.gov/wp-content/uploads/sites/337/2023/03/DFPI-Orders-Silicon-Valley-Bank-03102023.pdf?emrc=bedc09

[xi] See Moody’s, Moody’s downgrades Silvergate Bank’s deposit ratings to Caa1 from Ba3; ratings on review for downgrade, March 3, 2023. (https://www.moodys.com/research/Moodys-downgrades-Silvergate-Banks-deposit-ratings-to-Caa1-from-Ba3--PR_474469).