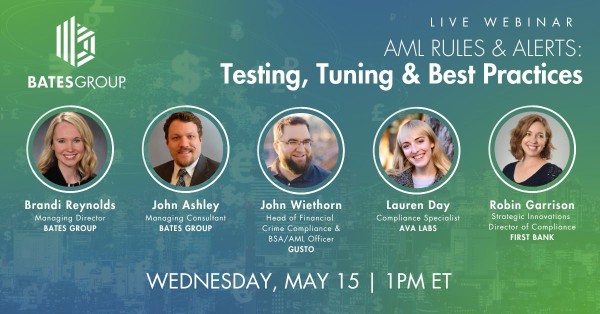

05-15-24

Webinar: Anti-Money Laundering Rules and Alerts—Testing, Tuning, and Best Practices

Discover strategies for optimizing AML rule sets and enhancing alert efficiency during this live webinar featuring industry leaders from Bates Group, Gusto, Ava Labs, and FirstBank.