White Papers

Markets can seem frustratingly complex when you don't know where to start, and spending time gathering background material is a burden that can leave you feeling less confident about your choices. Let Bates take care of the background for you, so you can spend your time building value elsewhere. Our White Papers are meant to be a jumping-off point to help you understand the legal, regulatory and compliance issues at hand.

04-11-24

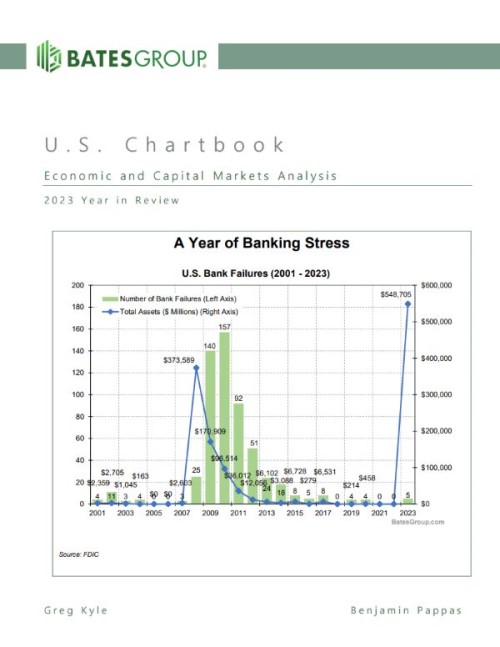

Economic and Capital Markets Analysis: 2023 Year in Review U.S. Chartbook

Detail

04-03-23

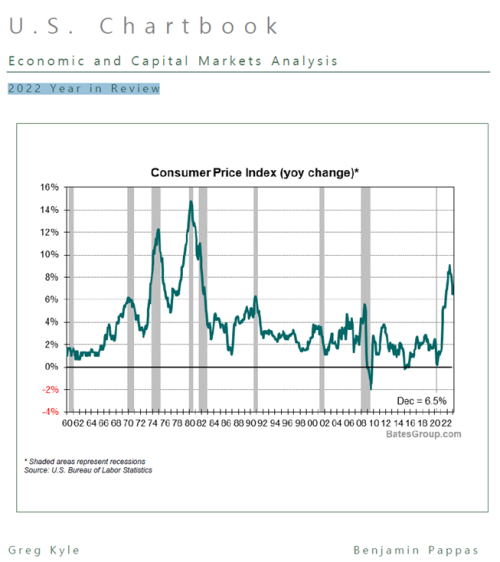

Economic and Capital Markets Analysis: 2022 Year in Review U.S. Chartbook

Detail

12-09-21

The Practicalities and Opportunities of Harnessing Technology and Big Data in Regulatory Enforcement and Compliance Practices

Detail

08-05-21

Bankruptcies are Rising - How is That Impacting Equity Holders?

Detail

05-21-21

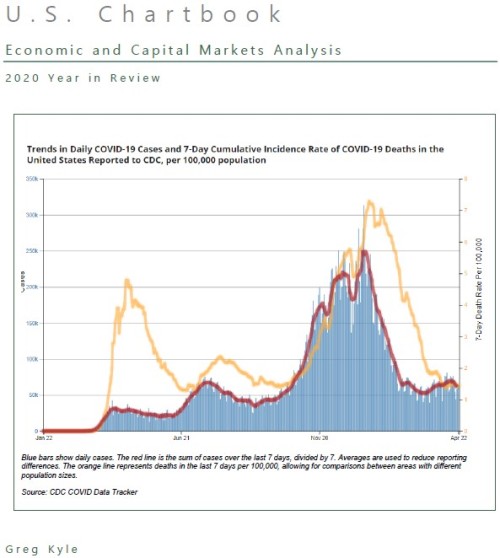

Bates U.S. Chartbook - 2020 Year in Review

Detail

04-30-21

Regulatory Concerns Grow for SPACs

Detail

03-10-21

The Anti-Money Laundering Act of 2020 and the Shifting AML Framework

Detail

02-04-21

UPDATE Broker-Dealer Branch Office Compliance: Remote Supervision, Inspections and Operational Considerations

Detail

11-06-20

Bates Compliance Roundtable: Highlights from Bates’ Zoom Call on Business Continuity Planning

Detail

06-02-20

Bear Markets, Black Swan Events and Volatility

Detail

03-31-20

Bates US Chartbook - 2019 Year in Review

Detail

03-10-20

Compliance Considerations in an RIA Merger or Acquisition

Detail

01-21-20

SEC’s Regulation Best Interest: Perspectives on Firm Compliance

Detail

09-04-19

Article: With Regulation BI, Are FINRA Rules 2010 and 2111 Dead?

Detail

08-02-19

Forensic Accounting in the Context of Litigation

Detail

05-07-19

Data Challenges in Wage and Hour Damages Analyses

Detail

01-11-19

AML Enforcement and Compliance: 2018 Year in Review and Observations for 2019

Detail

11-15-18

The Challenge of AML Leadership: A Conversation with Managing Director Edward Longridge

Detail

10-02-18

Navigating A Changing Landscape: Current Considerations When Addressing Senior Financial Fraud

Detail

06-17-15

Fixed Income Part Four - Reaching for Yield

Detail

06-11-15

Fixed Income Part Three - Bond Fund Investment

Detail

06-03-15

Fixed Income Part Two - Understanding Credit Ratings

Detail

03-12-15

Fixed Income Part One - Fee Selection and Reverse Churning

Detail

01-28-15

ERISA Part Four - ERISA - 3(16)

Detail

01-21-15

ERISA Part Three - Due Diligence for Service Providers

Detail

01-15-15

ERISA Part Two - Choosing the Right Type of Investment Advice

Detail

12-19-14

ERISA Part One - 3(21) v 3(38) Investment Assistance

Detail

07-03-14

High Frequency Trading - Intro Guide

Detail

05-27-14

Regulatory Brief - Rules for CPOs and CTAs

Detail

04-15-14

Private Placements

Detail

01-13-14

Regulatory Brief - ERA

Detail

06-07-13

REITS Explained

Detail

01-16-13

Libor Explained

Detail