09-11-20

CEO Message: 9/11 National Day of Remembrance

Today marks 19 years since the tragic and devastating events of 9/11. Read the message from Bates Group CEO Jennifer Stout

09-11-20

Today marks 19 years since the tragic and devastating events of 9/11. Read the message from Bates Group CEO Jennifer Stout

09-10-20

The North American Securities Administrators Association (“NASAA”) continues to assert its member states’ interests in fighting for and protecting investors and consumers in the financial markets. We have assembled a roundup of recent NASAA actions on enforcement, model legislation and regulatory policy, including updates on: COVID-19 enforcement, whistleblowers, restitution funds for securities fraud victims, SEC "Accredited Investor" definition, DOL advice proposal, FINRA proposed beneficiary arrangements, financial professionals with diminished capacity, and what to expect going forward.

09-03-20

Labor Day is almost here, which means those lazy, remote days of summer are coming to a close. What did you miss when you powered down this summer? We have a roundup of all the important Bates news, events and alerts from July and August as well as a sneak peek of the next few months to help you head into Fall fully prepared.

08-31-20

In an effort to broaden investment opportunities in private funds, the SEC expanded the definition of “accredited investor” to include a host of “natural persons” and other entities that would not otherwise qualify under the current rigorous disclosure and procedural requirements. The revised definition is intended to increase the number of investors that will have access to private investments.

08-26-20

A. Christine Davis, Managing Director - Forensic Accounting and Economic Damages, will be presenting the program “Filing a Business Interruption Claim: Properly Calculating the Business Income Loss” on August 27, 2020. Presented by the Canadian Institute of Actuaries.

08-20-20

Over the past several weeks, the Financial Crimes Enforcement Network (FinCEN) has issued new guidance on customer due diligence requirements, an advisory on cyber-enabled financial crime and an alert concerning scams involving fraudulent payments denominated in convertible virtual currency. These are significant compliance communications for financial institutions and come on the heels of FinCEN’s recent alerts on imposter fraud and money mule schemes.

08-20-20

Join Bates Expert and IBDC Founder/CEO Lilian Morvay, along with Bates Compliance Director Jill Ehret, Cybersecurity Expert Paul Horn and other panelists, for this complimentary webinar examining new compliance concerns arising out of the COVID-19 pandemic, including Branch Audits, Selling Away and more. Thursday, August 20, 2020 at 2:00 p.m. Eastern.

08-17-20

On August 12, 2020 the SEC Office of Compliance Inspections and Examinations (OCIE) staff alerted broker-dealers and investment advisers to additional COVID-19 compliance risks. The new considerations are based on the “operational, technological [and] commercial challenges” raised by the public and private sector response to the pandemic. OCIE staff grouped their observations and recommendations into several categories—here’s what you need to know:

08-06-20

Since our last regulatory update on the adoption of FINRA’s proposal to align its suitability and non-cash compensation rules with Regulation Best Interest (“Reg BI”), the self-regulatory organization issued guidance on private placement communications, recommended that firms provide information to them on digital assets, and proposed a series of new rule changes. Bates examines the details of FINRA’s updated guidance.

08-05-20

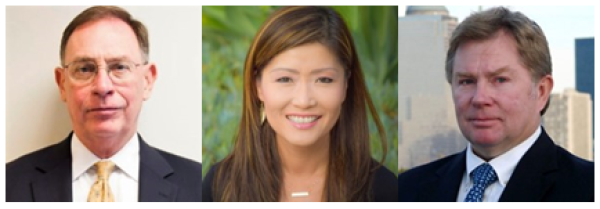

Join Bates Group’s next CLE Webinar on Thursday, August 13th, 2020, “Capital Market Uncertainty in the Time of COVID-19 and the Potential Litigation and Regulatory Impact” when we look at 2020 in the context of past bear markets, compare the 1918 influenza pandemic to today, discuss the sectors and industries hardest hit by the economic disruption, and potential capital market-related litigation and regulatory enforcement matters on the horizon. Featuring (L-R) co-moderators Jack McGuire of Oppenheimer & Co. and Esther Cho of Keesal, Young & Logan, along with Greg Kyle, Bates Group Director and Expert. REGISTER HERE

07-30-20

More than two years after the Fifth Circuit Court of Appeals vacated the Department of Labor’s fiduciary duty rule, the agency proposed new regulations on investment advice for retirement accounts under ERISA and the Internal Revenue Code. Under the heading “Improving Investment Advice for Workers & Retirees,” the DOL proposed a new “prohibited transaction class exemption” for investment adviser fiduciaries, reinstated the 1975 regulation and its five-part test for defining investment advice, and made certain changes to its pre-existing prohibited transaction class exemptions. Bates examines the details of the new DOL proposal.

07-24-20

Bates Group is proud to welcome our newest experts and consultants:

Amy Bard, Esq.- Sales Practice Litigation, Compliance, Senior Investors

Paula Barnes - Retail Industry Expert, Retail Contracts, Regulatory and Compliance investigations

Linda Houston - Wealth Management, Branch Management, Hiring and Recruiting, Retail Securities Litigation and Arbitration

Donald Mattersdorff, CFA - Investment Advisory, Risk Management, Securities Analysis (Equity and Fixed Income)

07-22-20

As Managing Director for Bates Group's Retail Litigation practice, Julie Johnstone manages and oversees financial litigation and arbitration matters. Her team assists broker-dealer and investment advisers, banks and insurance companies, as well as State and Federal Regulators, throughout the life cycle of their retail litigation matters, from early case assessments, profit and loss reports, damage analyses, and “what if” scenarios, to expert consultation and testimony at hearing, as well as mediation and settlement support. We asked Julie to consider the state of retail litigation in light of the pandemic and to anticipate some of the long-term implications on case management and dispute resolution going forward.

07-21-20

The COVID-19 pandemic has created new compliance and regulatory risks for financial institutions. New avenues for money laundering have sprung up, presenting challenges for financial institutions facing pandemic-related resource constraints. Join Bates Group and Orrick Herrington & Sutcliffe LLP for this CLE webinar which will examine how financial institutions can adapt their AML programs to the new financial environment and regulatory expectations. Thursday, July 30, 2020 at 12 p.m. Eastern.

07-16-20

In the past week, the SEC Office of Compliance Inspections and Examinations (OCIE) and the Financial Crimes Enforcement Network (FinCEN) warned financial institutions to guard against specific and increasingly prevalent types of fraud against consumers. These activities have been uncovered through examinations, suspicious activity reports (SARs), law enforcement information and public reporting. OCIE and FinCEN’s alerts follow other federal and state reports urging firms to increase vigilance against similar crisis-related misconduct.

07-15-20

The NSCP 2020 Midwest Regulatory Interchange with the SEC, DOL and FINRA is taking place on July 24, 2020. Bates Compliance Managing Director Linda Shirkey will be speaking on the SEC Discussions panel at 9 a.m. (Mountain).