Bates Research | 02-20-23

SEC 2023 Exam Priorities Comparison Chart and Summary: New Marketing Rule, Reg BI and Private Funds Top this Year’s List

In late March, 2022, the SEC Division of Examinations (“Exams Division”) set forth strategic priorities for the year to restore “trust necessary for our markets to thrive," during a “time of heightened market volatility.” According to leadership, last year’s emphasis was on “emerging issues, such as crypto-assets and expanding information security threats, as well as core compliance gaps affecting retail investors.” (See Bates 2022 exam priorities summary and chart.)

Ten months later, on February 7, 2023, the Exams Division announced a new focus, reflecting a shift in priorities for 2023 based on the need to adapt to “growing markets, evolving technologies, and new forms of risk.” The emphasis in this year’s SEC priorities announcement remains on protecting retail investors. However, the new priorities reflect the agency’s latest rulemakings, compliance expectations around earlier rulemakings and further adjustments toward “a risk-based approach to examination selection that balances our resources across a diverse registrant base.” In the report, the Exams Division is emphasizing compliance with the new marketing rule, new investment company regulations on derivatives and fair valuation, expectations around Regulation Best Interest (“Reg BI”), and registered investment advisers’ duties as to private funds.

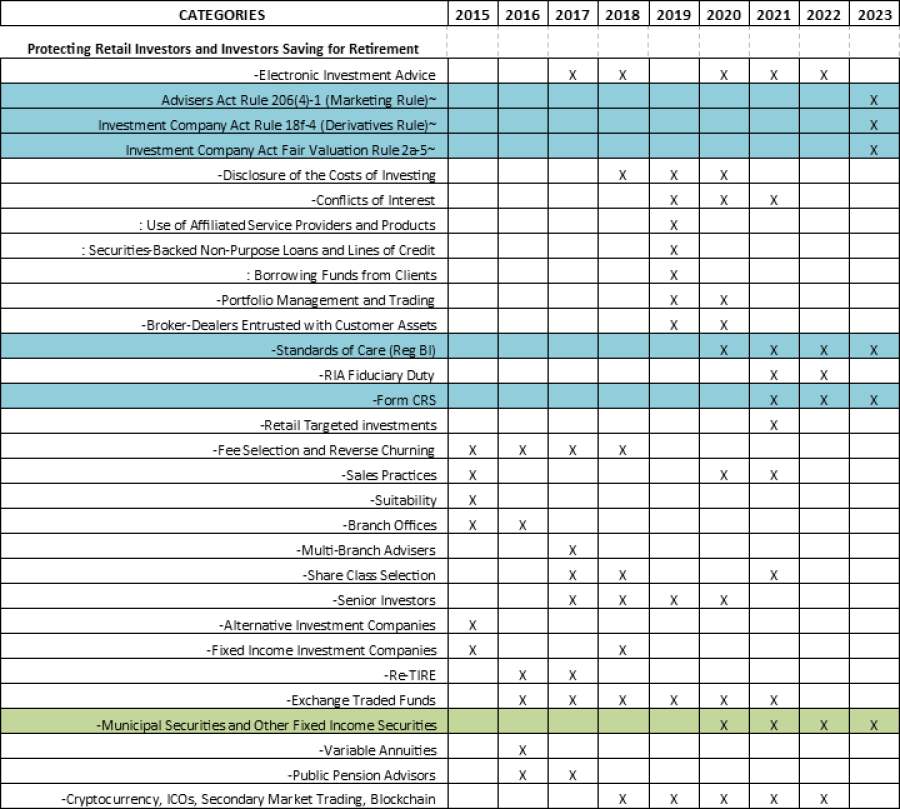

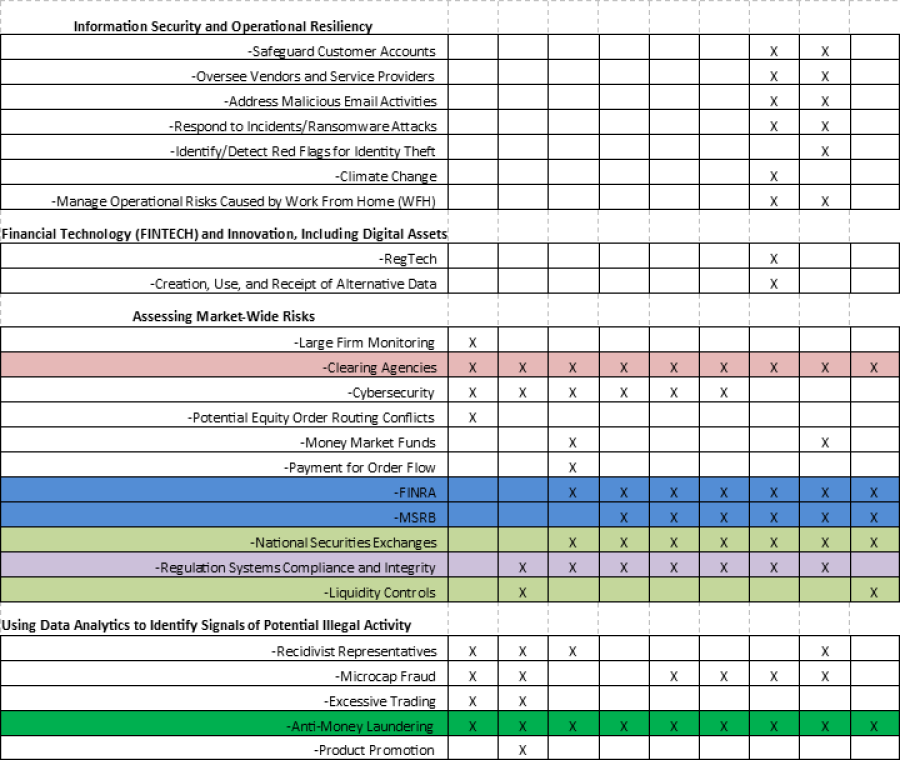

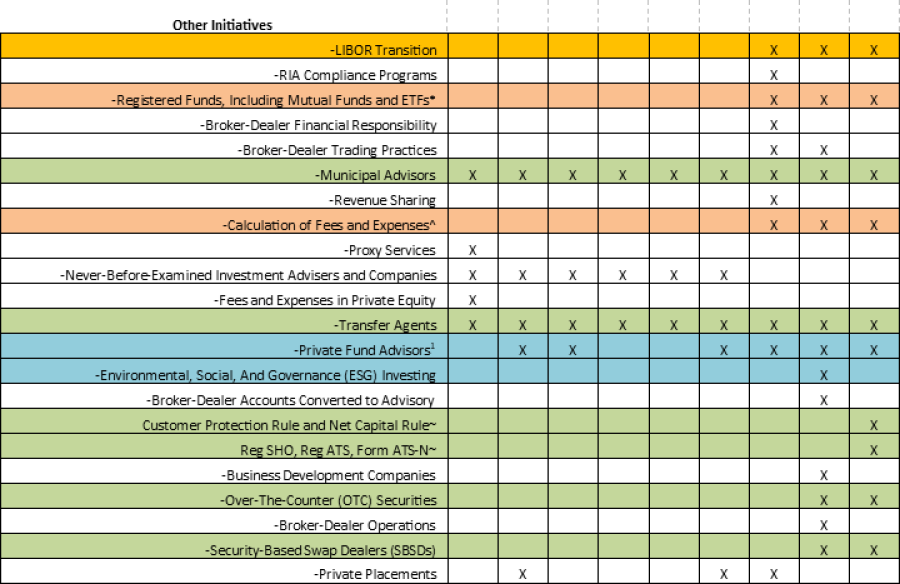

While there is overlap concerning subject matter between last year and this year (see Bates annual priorities comparison chart below), the priority shift toward ensuring compliance with the new rules has important implications for all regulated market participants. Here is our summary of the announced priorities for 2023.

SEC Leadership Messages

In the report, the SEC Exams Division leadership team reported on their efforts over the past year to: (i) respond to continued “market volatility, cyber-events, and market disruptions caused by recent bankruptcies and financial distress among crypto asset market participants;” (ii) promote compliance through risk alerts, exam deficiency communications and the instant priorities report; (iii) communicate about focused exams and enforcement sweep initiatives; (iv) engage in national and regional office proactive outreach; and (v) convey useful observations and information to the policy divisions working on rules and amendments. The leadership team also described internal organizational efforts made possible through the use of specialized working groups (in, e.g., technology, trading practices, complex products and marketing, and others,) to prevent fraud, monitor risk and better inform policy.

The SEC Division leaders also reported that, in fiscal year 2022, it examined approximately 15% of a growing registered investment adviser (“RIA”) population with more than $125 trillion in assets under management, and completed over 360 examinations of broker-dealers. Together with FINRA, the SEC said it examined nearly half of the approximately 3,500 registered broker-dealers during the course of the year.

Top Areas of SEC Focus for 2023

Highlighted Priorities for 2023

As can be seen in Bates’ 2023 priorities chart above (which maps out the changes in examination priorities since 2015), beyond the announced highlights, the Division expects registered entities to up their compliance efforts, particularly as to risk-based supervision, on all existing priorities. The Division highlighted the following priorities:

Marketing Rule

The Exams Division will examine for written policies and procedures covering the new rule and firms’ practices to ensure those rules are being followed. Advisers must lock down their documentation and reporting processes, and claims related to performance and services must be able to be substantiated. Advisers will need to be able to back up those claims. The SEC previously noted that they were concerned with, among other things: communications of hypothetical performance; reliability of performance communications; offers to expand a financial relationship; communications related to cross sales; information on investment strategies; and, in general, any adviser/intermediary/third-party distributed material conveyed to the investor.

Regulation Best Interest

The Exams Division stated that it will keep up its scrutiny of broker-dealers and advisers on compliance with their obligations under Reg BI, particularly by reviewing firm practices on management of conflicts of interest of all kinds, practices regarding considerations of investment alternatives vis-a-vis investment goals and account characteristics. The Division emphasized that it will zoom in on recommendations made on complex products, like derivatives and leveraged exchange-traded funds; “high cost and illiquid products, such as variable annuities and non-traded REITs;” and unconventional strategies, among others. (See also, recent Bates’ post on latest insights into FINRA and SEC Reg BI and Form CRS compliance.) In addition, the Division stated that it will review “agreements that purport to inappropriately waive or limit their standard of conduct, such as through the use of hedge clauses.”

Derivatives and Fair Valuation Rules

The Exams Division said it will test whether funds, including investment companies, mutual funds, exchange traded funds and business development companies, have policies and procedures and appropriate management programs, board oversight, and adequate disclosures to address derivative risk. The report noted that more than 35% of all RIAs (more than 5500) manage nearly 50,000 private funds with more than $21 trillion in gross assets.

The Exams Division will examine funds’ compliance with the new fair value rule, including reviewing board oversight, recordkeeping, and “permitting the funds’ board to designate valuation designees to perform fair value determinations.” The Division also said it will review funds’ valuation methodologies, compliance policies and procedures, governance practices, service provider oversight, and/or reporting and recordkeeping and any adjustments that have been made pursuant to the new rule requirements.

Private Funds

Consistent with the above priorities, the Exams Division will review RIA compliance under their fiduciary obligations. The Division said it will look at compliance and risk management programs, fees and expenses, conflicts of interest, marketing and performance advertising, and the “use of alternative data.” This is in addition to reviewing compliance on custody, portfolio strategies, and investment recommendations with a particular emphasis on (i) funds that are highly leveraged; (ii) private funds managed in tandem with business development companies; (iii) those that hold hard to value investments like crypto assets and real estate; and (iv) Special Purpose Acquisition Companies (“SPACs”).

Ongoing Priorities

Carried over from last year, the Exams Division said it continues to prioritize compliance requirements on crypto assets, environment, social and governance considerations, on information security and operational resilience and on anti-money laundering compliance.

Crypto Assets

The Exams Division will continue to focus “on the offer, sale, recommendation of, or advice regarding trading in crypto or crypto-related assets.” The exams will focus on practices that utilize “technological and on-line solutions to meet the demands of compliance and marketing and to service investor accounts,” from online trading to robo-advisers to automated tools and platforms. The Division cautioned that its exams may reach into an “entity’s history, operations, services, products offered, and other risk factors.”

ESG

The Division will continue to prioritize exams on ESG-related advisory services and fund offerings, particularly as to whether fund disclosures are adequate and accurate, and whether recommendations on ESG products are in the best interest of the retail investor.

Information Security

The Division warned that the risk level is elevated with respect to cybersecurity threats to RIAs, broker-dealers, investment companies, municipal advisers, transfer agents, exchanges and clearing agencies. The Division said it will review recommendations, governance, disclosure and risk management policies and procedures, as well as practices to protect investor information, records, and assets.

The Division highlighted that it will review cybersecurity issues concerning the use of third-party vendors. This includes “the security and integrity of third-party products and services and whether there has been an unauthorized use of third-party providers.” That also means that the Exams Division will look at firms’ practices to prevent account intrusions and to safeguard customer records and information.

Anti-Money Laundering

Among the perennial compliance concerns the Exams Division prioritized is advisers and broker dealers’ obligations under the Bank Secrecy Act. The Division reported that due to the “current geopolitical environment and the increased imposition of international sanctions,” the risk level is elevated. As a result, the Division will be reviewing firm compliance to ensure that AML programs are tailored to firm risks based on, among other things, location, size, activities, customers, and products and services. The Division also will continue to examine the firm’s programs, policies and procedures to test whether they are “reasonably designed to identify and verify the identity of customers and beneficial owners of legal entity customers, perform customer due diligence, monitor for suspicious activity, and, file Suspicious Activity Reports (SARs) with the Financial Crimes Enforcement Network."

General Compliance Considerations

In the report, the Exams Division reminds registered firms of their general compliance obligations. Though not highlighted by subject matter in this year’s report, they reinforce the message that there will be no let-up in general compliance oversight while underscoring the specific areas of focus identified above. The report contains chapters for RIAs (on compliance with “core functions” as to how RIAs’ operations and practices incorporate current market factors that might impact valuation and reporting accuracy); Registered Investment Companies (on the fiduciary obligations RIAs have toward registered investment companies – particularly, with respect to compensation); and broker-dealers (on supervisory programs over, for example, electronic communications related to firm business.)

Conclusion

A good companion piece to this year’s Exams Division report would be the SEC Enforcement report issued in November 2022 which highlighted enforcement actions concerning Reg BI, complex products and strategies, conflicts of interest, and also included descriptions of important cases concerning private funds, cryptocurrency, cybersecurity and ESG. Taken together, firm leadership can get a good sense for how many ways and how quickly compliance failures could blossom into enforcement actions.

On subject matter, this year’s Exams report offers few surprises, as the top priorities relate to recent rulemakings (i.e., marketing rule, fair valuation and derivatives) and not-so-recent prior rulemakings that the SEC expects firms to have absorbed into their compliance programs and culture (i.e., Reg BI). As to expectations around adviser and broker-dealer standards post-enactment of Reg BI, it seems clear that similar considerations now permeate private funds practice as well. This is consistent with observations made last year that the Division’s priorities reflect new rules. As this year’s Bates chart shows, compliance regulation continues to expand to cover more products, more services, and more perceived risk. Bates will continue keep you apprised.

To discuss support for these regulatory and compliance priorities, please contact Bates today:

For more information concerning Bates Group's practices and services, please visit:

Bates Compliance

-

Reg BI Services and Support

-

RIA Compliance Services

-

Broker-Dealer Compliance Services

-

Bates Investor Risk Assessment for Vulnerable and Senior Investors

-

Anti-Money Laundering and BSA Compliance

-

MSB, FinTech and Cryptocurrency